Insurance Blog

Disclaimer

The views, information, and comments in this blog should be understood as the personal opinions of the author and provide only a simplified description of coverages and is not a statement of contract. Insurance products and coverages may not apply in all states.

The Big Beautiful Law of Tax Changes

Thursday, July 17, 2025 1 Stop Benefits & Gork

Key Updates for Businesses and Individuals - Effective 2025

For Businesses

Key Updates for Businesses and Individuals - Effective 2025

For Businesses

- Corporate Tax Rate reduced to 15%.

- 100% Bonus Depreciation restored for qualifying assets.

- Section 179 Expensing limit increased to $2.5 million.

- Immediate R&D expensing reinstated and made permanent.

- 20% Pass-Through Deduction (Section 199A) made permanent.

- QSBS gain exclusion expanded: 50% (3 years), 75% (4 years), 100% (5+ years).

- Opportunity Zones policy made permanent starting 2027.

- Employer-Provided Childcare Credits increased to 40% (50% for small businesses), max $500,000 ($600,000 for small businesses).

- Charitable Deduction floor set at 1% for C corporations.

- Excess Business Loss Limitation made permanent: $313,000 (single), $626,000 (joint).

- Clean Energy Credits terminated for commercial vehicles post-September 30, 2025.

- Endowment excise tax for private colleges increased to up to 8%.

- PTET deductions preserved for SALT cap workarounds.

- Income Tax Rates (10%-37%) made permanent, with inflation adjustments from 2026.

- Standard Deduction increased: $15,750 (single), $23,625 (head of household), $31,500 (joint) for 2025.

- SALT Deduction cap raised to $40,000 (2025-2029), reverts to $10,000 in 2030.

- Social Security benefits tax eliminated with a $6,000 deduction (2025-2028).

- Tip Income Deduction up to $25,000 (2025-2028).

- Overtime Income Deduction up to $12,500 ($25,000 joint) (2025-2028).

- Car Loan Interest Deduction up to $10,000 (2025-2028).

- Child Tax Credit increased to $2,200, with $1,700 refundable, adjusted for inflation.

- Adoption Tax Credit: $5,000 refundable of $17,280, adjusted for inflation.

- 529 Plan distributions expanded to $20,000 for K-12 expenses.

- Trump Accounts: $1,000 tax-exempt savings for children born 2025-2029.

- Estate Tax exemption increased to $15 million (individuals), adjusted for inflation.

- Personal Exemptions permanently eliminated, except for seniors.

- Clean Energy Credits terminated for EVs and charging equipment post-2025.

- Dependent Care Assistance limit increased to $7,500 after 2025.

- Charitable Deduction floor set at 0.5% for itemizers.

- Moving Expenses deduction permanently repealed, except for Armed Forces.

Understanding the New ICHRA Rules Under the One Big Beautiful Bill Act: A Game-Changer for Employers

Wednesday, July 16, 2025 1 Stop Benefits, Inc. and Grok

Understanding the New ICHRA Rules Under the One Big Beautiful Bill Act: A Game-Changer for Employers

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, has brought significant changes to employee benefits, including updates to Individual Coverage Health Reimbursement Arrangements (ICHRAs). Rebranded as Custom Health Option and Individual Care Expense (CHOICE) Arrangements, these updates codify and enhance ICHRA, offering employers and employees greater flexibility and tax advantages. Below, we explore the key changes and how employers are leveraging them to optimize health benefits.

Key Changes to ICHRA Under the OBBBA

Understanding the New ICHRA Rules Under the One Big Beautiful Bill Act: A Game-Changer for Employers

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, has brought significant changes to employee benefits, including updates to Individual Coverage Health Reimbursement Arrangements (ICHRAs). Rebranded as Custom Health Option and Individual Care Expense (CHOICE) Arrangements, these updates codify and enhance ICHRA, offering employers and employees greater flexibility and tax advantages. Below, we explore the key changes and how employers are leveraging them to optimize health benefits.

Key Changes to ICHRA Under the OBBBA

- Codification into Law: Previously operating under 2019 regulatory guidance, ICHRAs are now formalized as CHOICE Arrangements in federal law, ensuring long-term stability regardless of administrative changes. This gives employers confidence in adopting and maintaining these plans.

- Increased Flexibility for Small Employers: Small businesses (fewer than 50 employees) can now offer both CHOICE Arrangements and traditional group health plans to the same employee class, a significant shift from previous restrictions. This allows tailored benefits strategies, such as offering part-time workers a CHOICE Arrangement while providing salaried employees a group plan.

- Pre-Tax Premium Payments: Employees can now pay their share of individual health insurance premiums (including ACA Marketplace plans) on a pre-tax basis through Section 125 cafeteria plans. This change enhances affordability for employees and simplifies administration for employers.

- Small Business Tax Credits: The OBBBA introduces a two-year tax credit for small businesses: $100 per employee per month in the first year and $50 per month in the second year. This incentive encourages adoption among smaller employers, making health benefits more accessible.

- Reduced Notice Period: The required notice period for informing employees about CHOICE Arrangements has been shortened from 90 days to 60 days, easing administrative burdens and allowing faster implementation.

- W-2 Reporting Requirement: Employers must now include the CHOICE Arrangement amount on employees' Form W-2, improving transparency and compliance.

- Employers are embracing CHOICE Arrangements for their flexibility, cost control, and employee satisfaction benefits. Here's how:

- Cost Management: Unlike traditional group health plans, CHOICE Arrangements allow employers to set a fixed budget for health benefits, avoiding unpredictable premium increases. This is particularly appealing to small and midsize businesses seeking cost-effective alternatives.

- Employee Choice and Satisfaction: Employees can select individual health plans that best fit their needs, from ACA Marketplace options to off-exchange plans. This personalization enhances employee satisfaction and helps attract talent in competitive markets.

- Tax Advantages: The ability to offer pre-tax premium payments and the new tax credits for small businesses make CHOICE Arrangements financially attractive. Employers can provide robust benefits while reducing tax liabilities.

Scalability Across Business Sizes: With no size restrictions or contribution caps, CHOICE Arrangements are scalable for businesses of all sizes, from startups to large corporations. This flexibility supports diverse workforce needs, such as varying allowances for full-time, part-time, or seasonal employees. Compliance with ACA: CHOICE Arrangements help employers meet Affordable Care Act (ACA) mandates by ensuring affordability (premiums not exceeding 9.02% of household income for self-only coverage). Employers can design plans to avoid penalties while offering employees access to Marketplace subsidies if needed.

2025 ACA & Medicaid Changes: What You Need to Know

Sunday, July 6, 2025 1 Stop Benefits, Inc.

Big changes to health insurance rules are here-and many people could lose coverage if they don't act. We're here to make sure that's not you.

No More Auto-Renewals

What this means:

If you have an ACA Marketplace plan, you'll now need to re-apply every year. No more automatic re-enrollment.

What to do:

Big changes to health insurance rules are here-and many people could lose coverage if they don't act. We're here to make sure that's not you.

No More Auto-Renewals

What this means:

If you have an ACA Marketplace plan, you'll now need to re-apply every year. No more automatic re-enrollment.

What to do:

Big changes to health insurance rules are here-and many people could lose coverage if they don't act. We're here to make sure that's not you.

No More Auto-Renewals

What this means:

If you have an ACA Marketplace plan, you'll now need to re-apply every year. No more automatic re-enrollment.

What to do:

Big changes to health insurance rules are here-and many people could lose coverage if they don't act. We're here to make sure that's not you.

No More Auto-Renewals

What this means:

If you have an ACA Marketplace plan, you'll now need to re-apply every year. No more automatic re-enrollment.

What to do:

- Mark your calendar for the shorter Open Enrollment period.

- Work with us early-we'll make sure your application is submitted on time and with all documentation.

- Be ready to show pay stubs, tax info, or other documents during the year.

- Let us help with gathering and uploading your documents.

- Let us shop all available options-Marketplace, off-Marketplace, short-term, or employer alternatives.

- Ask about bundling dental, vision, or enhanced life and long-term care benefits.

- Check if you qualify for an exemption (health, caregiving, student status).

- We'll help track and report work hours or file exemption paperwork.

- We can explore affordable private options that don't rely on ACA subsidies.

- Ask us about guaranteed issue and low-premium limited benefit plans.

Part-Time Surveys, Full-Time Health Benefits: A Smarter Way to Get Covered

Wednesday, April 10, 2025 Craig Chapin

In today's evolving healthcare environment, innovative programs are reshaping how individuals access meaningful, affordable coverage. LifeX and Population Science Management (PSM) are leading the charge by offering a unique model: contribute to public health research through short, part-time surveys-and in return, gain access to comprehensive group health insurance.

How It Works

Both companies hire individuals as part-time associates to complete occasional surveys- each typically taking just 5 to 10 minutes, with only a few hours required over the course of a year. Participants are paid for their time and, more importantly, gain access to high-quality, off-exchange health insurance plans.

At 1 Stop Benefits, Inc., we're proud to serve as a recruiting partner for these programs, connecting individuals with this smart, impactful opportunity. It's a win-win: contribute to better public health while securing valuable coverage for yourself and your family.

In today's evolving healthcare environment, innovative programs are reshaping how individuals access meaningful, affordable coverage. LifeX and Population Science Management (PSM) are leading the charge by offering a unique model: contribute to public health research through short, part-time surveys-and in return, gain access to comprehensive group health insurance.

How It Works

Both companies hire individuals as part-time associates to complete occasional surveys- each typically taking just 5 to 10 minutes, with only a few hours required over the course of a year. Participants are paid for their time and, more importantly, gain access to high-quality, off-exchange health insurance plans.

At 1 Stop Benefits, Inc., we're proud to serve as a recruiting partner for these programs, connecting individuals with this smart, impactful opportunity. It's a win-win: contribute to better public health while securing valuable coverage for yourself and your family.

Highlights of Off-Exchange Group Health Plans

Ready to learn more or see if you qualify? Reach out to 1 Stop Benefits today-we're happy to walk you through your options and answer any questions, with no pressure. Call us at 1-800-662-3982 or email: info@1StopBenefits.com to get started.

Highlights of Off-Exchange Group Health Plans

- Flexible Plan Options -- Choose from a range of deductibles and coverage levels

- Great for High Earners -- Ideal for those ineligible for ACA subsidies

- Eligibility -- Available to 1099 contractors, self-employed professionals, and non-working individuals under age 65

By classifying survey participants as part-time associates, LifeX and PSM can offer group health plans-making comprehensive insurance accessible to more people, especially those who fall through the cracks of traditional systems.

- No Balance Billing -- Pre-negotiated rates help reduce unexpected costs

- Lower Shared Expenses -- In-network care keeps your out-of-pocket costs down

- Comprehensive Benefits -- Includes telehealth, pharmacy coverage, and chronic care support

- Freedom of Access -- Nationwide networks with no referrals required

- LifeX -- Tiered premiums with access to PHCS, Cigna, and Anthem

- PSM -- Nationwide access via Blue Cross Blue Shield and PHCS

- Health Surveys + EHRs -- Combine insights for a full picture of health trends

- Predictive Analytics -- Identify emerging risks and support early intervention

- Personalized Solutions -- Tailor strategies to improve community health outcomes

Ready to learn more or see if you qualify? Reach out to 1 Stop Benefits today-we're happy to walk you through your options and answer any questions, with no pressure. Call us at 1-800-662-3982 or email: info@1StopBenefits.com to get started.

Two Plans Are Better Than One

Monday, August 21, 2023 Craig E Chapin

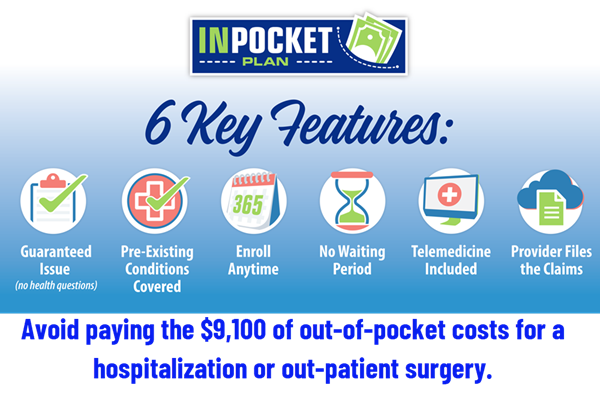

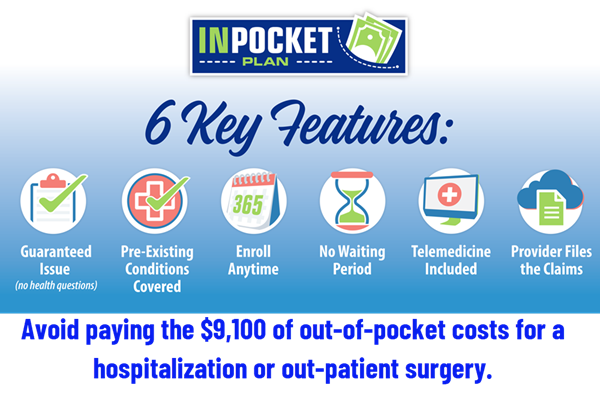

In an ever-changing healthcare landscape, arming yourself with knowledge about health insurance is vital not only for your physical health but also for your financial security. A new insurance plan offers relief to individuals covered by Affordable Care individual health plans regardless of medical conditions and without the standard exclusions. Now, having two insurance plans provides lower out-of-pocket costs than one. The MOOP (maximum out-of-pocket) expenses will be $9,200 per individual and $18,400 per family 2025. Tiered health plans can speed up your obligations. Start saving or read on.

In the insurance industry, one thing remains consistent. 20% of people use 80% of healthcare expenses. Since the Obama Care began, individuals have been insured regardless of their pre-existing conditions or medical expenses. Premium costs have been increasing every year since the law was passed. However, for many participants, the actual premium cost is not obvious as the subsidies granted by the Affordable Care Act offset the increases. What is apparent is that the out-of-pocket costs are increasing and are unaffordable for the average family.

For many, hospital indemnity insurance plans fill the gap for a fraction of the cost of buying up to gold health plans. However, not all states allow hospital indemnity plans to be offered to individuals. Most do not cover the significant upfront costs on the first day in the hospital, and few cover outpatient surgeries. Most are also unavailable to people with pre-existing conditions, and just about all do not cover maternity and mental health expenses.

Life happens, and everyone needs to set up an emergency fund or leverage their limited funds. Solutions now exist to cover your medical bills for accidents only or both sickness and accidents. Do the math to save money by comparing the MOOP and premiums on bronze, silver, and gold individual health plans. People covered by tiered networks (i.e., Proactive Plans) must understand that an ambulance takes you to the nearest hospital regardless of tier status or network. (St Mary's is Tier 3 with Keystone Proactive Plans). Consider lowering your out-of-pocket costs for families planning on more children or baby boomers with a higher risk of hospitalization. Sleep better knowing you can afford to be taken to the nearest hospital or get treated without the risk of medical bankruptcy.

In an ever-changing healthcare landscape, arming yourself with knowledge about health insurance is vital not only for your physical health but also for your financial security. A new insurance plan offers relief to individuals covered by Affordable Care individual health plans regardless of medical conditions and without the standard exclusions. Now, having two insurance plans provides lower out-of-pocket costs than one. The MOOP (maximum out-of-pocket) expenses will be $9,200 per individual and $18,400 per family 2025. Tiered health plans can speed up your obligations. Start saving or read on.

In the insurance industry, one thing remains consistent. 20% of people use 80% of healthcare expenses. Since the Obama Care began, individuals have been insured regardless of their pre-existing conditions or medical expenses. Premium costs have been increasing every year since the law was passed. However, for many participants, the actual premium cost is not obvious as the subsidies granted by the Affordable Care Act offset the increases. What is apparent is that the out-of-pocket costs are increasing and are unaffordable for the average family.

For many, hospital indemnity insurance plans fill the gap for a fraction of the cost of buying up to gold health plans. However, not all states allow hospital indemnity plans to be offered to individuals. Most do not cover the significant upfront costs on the first day in the hospital, and few cover outpatient surgeries. Most are also unavailable to people with pre-existing conditions, and just about all do not cover maternity and mental health expenses.

Life happens, and everyone needs to set up an emergency fund or leverage their limited funds. Solutions now exist to cover your medical bills for accidents only or both sickness and accidents. Do the math to save money by comparing the MOOP and premiums on bronze, silver, and gold individual health plans. People covered by tiered networks (i.e., Proactive Plans) must understand that an ambulance takes you to the nearest hospital regardless of tier status or network. (St Mary's is Tier 3 with Keystone Proactive Plans). Consider lowering your out-of-pocket costs for families planning on more children or baby boomers with a higher risk of hospitalization. Sleep better knowing you can afford to be taken to the nearest hospital or get treated without the risk of medical bankruptcy.

In an ever-changing healthcare landscape, arming yourself with knowledge about health insurance is vital not only for your physical health but also for your financial security. A new insurance plan offers relief to individuals covered by Affordable Care individual health plans regardless of medical conditions and without the standard exclusions. Now, having two insurance plans provides lower out-of-pocket costs than one. The MOOP (maximum out-of-pocket) expenses will be $9,200 per individual and $18,400 per family 2025. Tiered health plans can speed up your obligations. Start saving or read on.

In the insurance industry, one thing remains consistent. 20% of people use 80% of healthcare expenses. Since the Obama Care began, individuals have been insured regardless of their pre-existing conditions or medical expenses. Premium costs have been increasing every year since the law was passed. However, for many participants, the actual premium cost is not obvious as the subsidies granted by the Affordable Care Act offset the increases. What is apparent is that the out-of-pocket costs are increasing and are unaffordable for the average family.

For many, hospital indemnity insurance plans fill the gap for a fraction of the cost of buying up to gold health plans. However, not all states allow hospital indemnity plans to be offered to individuals. Most do not cover the significant upfront costs on the first day in the hospital, and few cover outpatient surgeries. Most are also unavailable to people with pre-existing conditions, and just about all do not cover maternity and mental health expenses.

Life happens, and everyone needs to set up an emergency fund or leverage their limited funds. Solutions now exist to cover your medical bills for accidents only or both sickness and accidents. Do the math to save money by comparing the MOOP and premiums on bronze, silver, and gold individual health plans. People covered by tiered networks (i.e., Proactive Plans) must understand that an ambulance takes you to the nearest hospital regardless of tier status or network. (St Mary's is Tier 3 with Keystone Proactive Plans). Consider lowering your out-of-pocket costs for families planning on more children or baby boomers with a higher risk of hospitalization. Sleep better knowing you can afford to be taken to the nearest hospital or get treated without the risk of medical bankruptcy.

In an ever-changing healthcare landscape, arming yourself with knowledge about health insurance is vital not only for your physical health but also for your financial security. A new insurance plan offers relief to individuals covered by Affordable Care individual health plans regardless of medical conditions and without the standard exclusions. Now, having two insurance plans provides lower out-of-pocket costs than one. The MOOP (maximum out-of-pocket) expenses will be $9,200 per individual and $18,400 per family 2025. Tiered health plans can speed up your obligations. Start saving or read on.

In the insurance industry, one thing remains consistent. 20% of people use 80% of healthcare expenses. Since the Obama Care began, individuals have been insured regardless of their pre-existing conditions or medical expenses. Premium costs have been increasing every year since the law was passed. However, for many participants, the actual premium cost is not obvious as the subsidies granted by the Affordable Care Act offset the increases. What is apparent is that the out-of-pocket costs are increasing and are unaffordable for the average family.

For many, hospital indemnity insurance plans fill the gap for a fraction of the cost of buying up to gold health plans. However, not all states allow hospital indemnity plans to be offered to individuals. Most do not cover the significant upfront costs on the first day in the hospital, and few cover outpatient surgeries. Most are also unavailable to people with pre-existing conditions, and just about all do not cover maternity and mental health expenses.

Life happens, and everyone needs to set up an emergency fund or leverage their limited funds. Solutions now exist to cover your medical bills for accidents only or both sickness and accidents. Do the math to save money by comparing the MOOP and premiums on bronze, silver, and gold individual health plans. People covered by tiered networks (i.e., Proactive Plans) must understand that an ambulance takes you to the nearest hospital regardless of tier status or network. (St Mary's is Tier 3 with Keystone Proactive Plans). Consider lowering your out-of-pocket costs for families planning on more children or baby boomers with a higher risk of hospitalization. Sleep better knowing you can afford to be taken to the nearest hospital or get treated without the risk of medical bankruptcy.

Updates to Medicare Part D Medication Coverage

Tuesday, July 18, 2023 Craig E Chapin

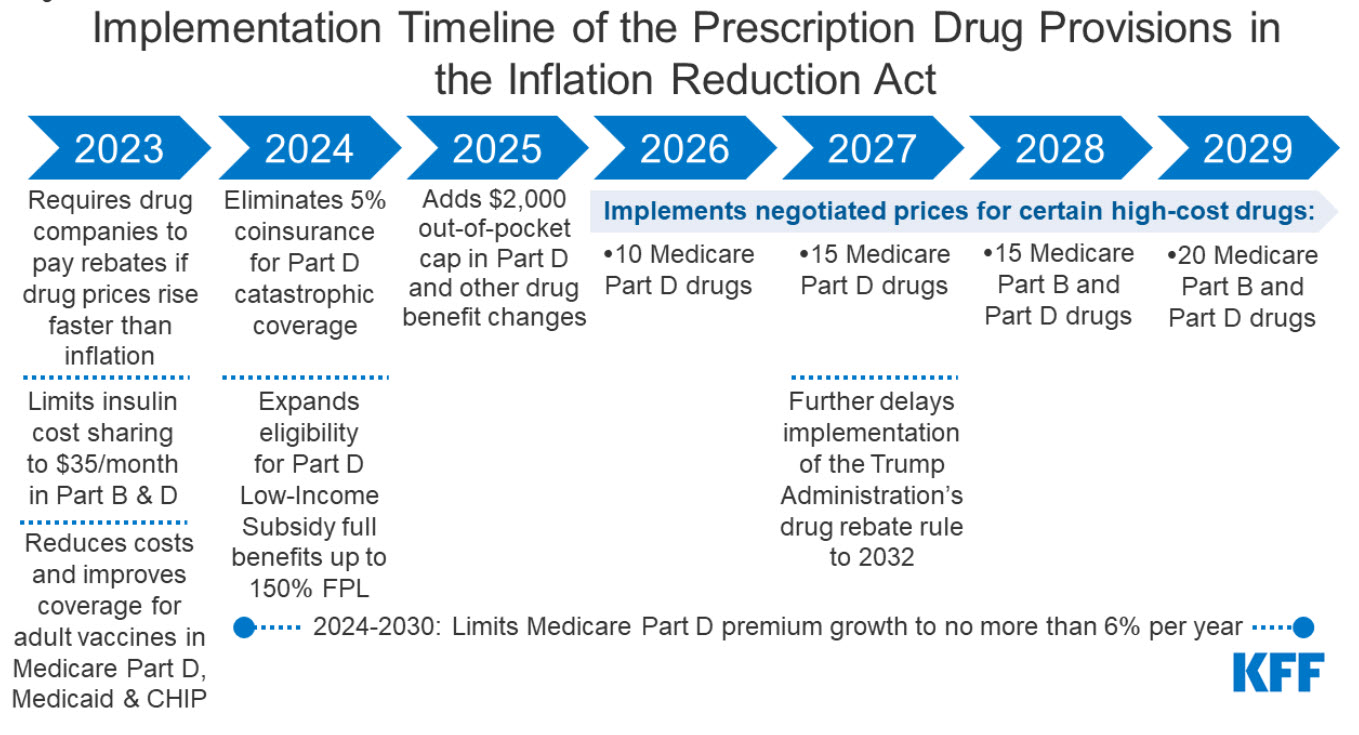

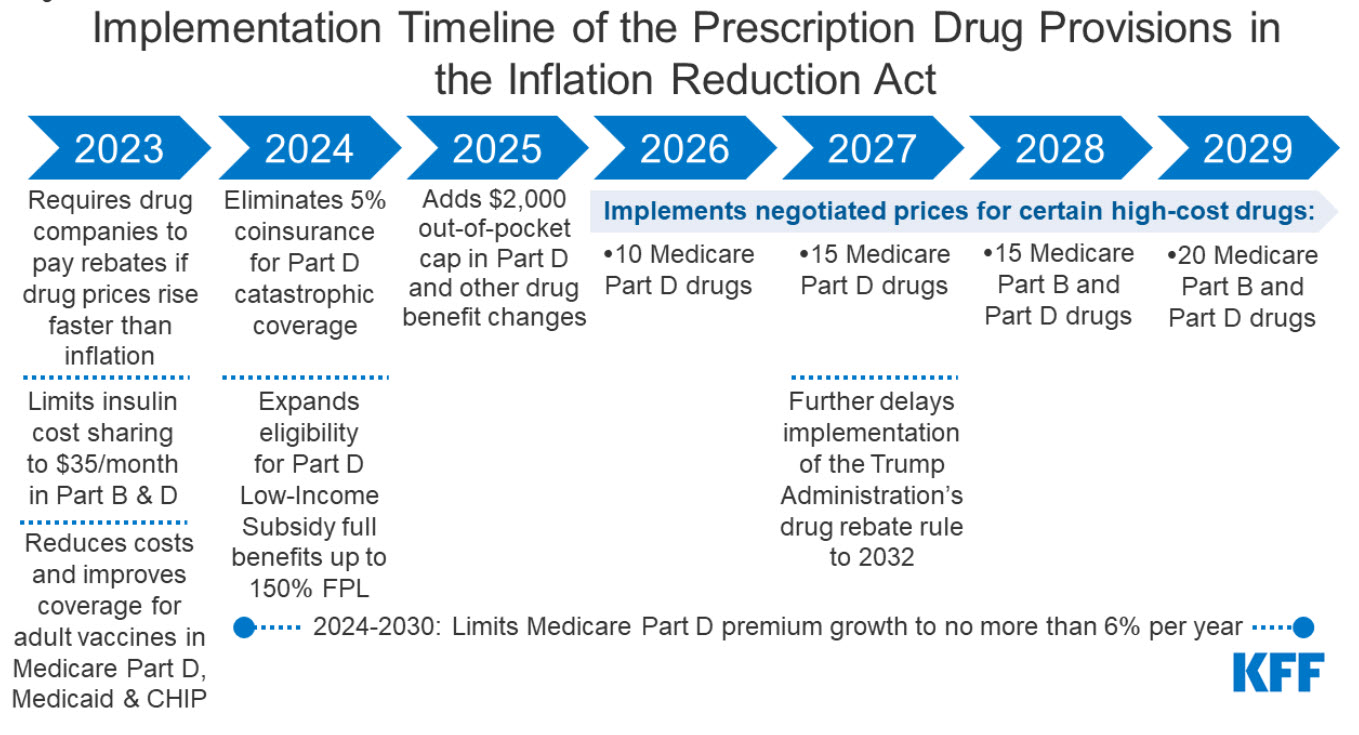

Staying informed about changes to Medicare Part D medication coverage is essential for understanding how these updates may impact healthcare expenses and treatment options. This blog post will explore the recent Medicare Part D medication coverage improvements that the Infl initiated by the Inflation Reduction Act.

1. The law requires the federal government to negotiate prices for some high-cost drugs covered under Medicare. Medicare Part D and Part B drug spending are highly concentrated among a relatively small share of covered drugs, mainly those without generic or biosimilar competitors. Under the Inflation Reduction Act, brand-name and biologic drugs without generic or biosimilar equivalents covered under Medicare Part D that are among the highest-spending Medicare-covered drugs are eligible for negotiation. The number of negotiated drugs is limited to 10 Part D drugs in 2026, another 15 Part D drugs in 2027, another 15 Part B and Part D drugs in 2028, and another 20 Part B and Part D drugs in 2029 and later years.

2. The law requires drug manufacturers to pay Medicare rebates if they increase prices faster than inflation for drugs used by Medicare beneficiaries. The inflation rebate provision will be implemented in 2023, using 2021 as the base year for determining price changes relative to inflation.

3. The law Caps Medicare beneficiaries' out-of-pocket spending under the Medicare Part D benefit, first eliminating coinsurance above the catastrophic threshold in 2024 and then adding a $2,000 cap on spending in 2025. It also limits annual increases in Part D premiums from 2024 to 2030 and makes other changes to the Part D benefit design.

4. Beginning in 2023, the bill limits cost-sharing for insulin to $35 per month for people with Medicare, including covered insulin products in Medicare Part D plans, beginning January 1, 2023, and for insulin furnished through durable medical equipment under Medicare Part B, starting July 1, 2023.

5. Eliminates cost-sharing for adult vaccines covered under Medicare Part D, as of 2023, and improves access to adult vaccines under Medicaid and CHIP.

6. It expands eligibility for full Part D Low-Income Subsidies (LIS) in 2024 to low-income beneficiaries with incomes up to 150% of poverty and modest assets and repeals the partial LIS benefit currently in place for individuals with incomes between 135% and 150% of poverty.

7. Expanded Medication Therapy Management (MTM) Services: MTM services have been expanded to provide enhanced support and guidance. This helps ensure effective medication use, improves health outcomes, and minimizes drug-related issues.

8. Enhanced Information and Decision-Making Tools: Beneficiaries now have improved resources for informed decision-making. The updated Plan Finder tool offers accurate cost estimates and helps select the most suitable Part D plan based on individual medication needs.

Conclusion: Staying updated on Medicare Part D medication coverage changes is crucial for beneficiaries seeking affordable and necessary prescription drugs. Recent enhancements, including improved coverage in the donut hole, biosimilar discounts, expanded catastrophic coverage threshold, expanded MTM services, and enhanced information tools, contribute to greater affordability and accessibility. Beneficiaries are encouraged to remain informed, review their Part D plan regularly, and utilize available resources to make informed decisions about prescription drug coverage.

Disclaimer: The information provided is for educational purposes only and not legal or financial advice. Consult a qualified professional for personalized guidance regarding your specific situation.

Staying informed about changes to Medicare Part D medication coverage is essential for understanding how these updates may impact healthcare expenses and treatment options. This blog post will explore the recent Medicare Part D medication coverage improvements that the Infl initiated by the Inflation Reduction Act.

1. The law requires the federal government to negotiate prices for some high-cost drugs covered under Medicare. Medicare Part D and Part B drug spending are highly concentrated among a relatively small share of covered drugs, mainly those without generic or biosimilar competitors. Under the Inflation Reduction Act, brand-name and biologic drugs without generic or biosimilar equivalents covered under Medicare Part D that are among the highest-spending Medicare-covered drugs are eligible for negotiation. The number of negotiated drugs is limited to 10 Part D drugs in 2026, another 15 Part D drugs in 2027, another 15 Part B and Part D drugs in 2028, and another 20 Part B and Part D drugs in 2029 and later years.

2. The law requires drug manufacturers to pay Medicare rebates if they increase prices faster than inflation for drugs used by Medicare beneficiaries. The inflation rebate provision will be implemented in 2023, using 2021 as the base year for determining price changes relative to inflation.

3. The law Caps Medicare beneficiaries' out-of-pocket spending under the Medicare Part D benefit, first eliminating coinsurance above the catastrophic threshold in 2024 and then adding a $2,000 cap on spending in 2025. It also limits annual increases in Part D premiums from 2024 to 2030 and makes other changes to the Part D benefit design.

4. Beginning in 2023, the bill limits cost-sharing for insulin to $35 per month for people with Medicare, including covered insulin products in Medicare Part D plans, beginning January 1, 2023, and for insulin furnished through durable medical equipment under Medicare Part B, starting July 1, 2023.

5. Eliminates cost-sharing for adult vaccines covered under Medicare Part D, as of 2023, and improves access to adult vaccines under Medicaid and CHIP.

6. It expands eligibility for full Part D Low-Income Subsidies (LIS) in 2024 to low-income beneficiaries with incomes up to 150% of poverty and modest assets and repeals the partial LIS benefit currently in place for individuals with incomes between 135% and 150% of poverty.

7. Expanded Medication Therapy Management (MTM) Services: MTM services have been expanded to provide enhanced support and guidance. This helps ensure effective medication use, improves health outcomes, and minimizes drug-related issues.

8. Enhanced Information and Decision-Making Tools: Beneficiaries now have improved resources for informed decision-making. The updated Plan Finder tool offers accurate cost estimates and helps select the most suitable Part D plan based on individual medication needs.

Conclusion: Staying updated on Medicare Part D medication coverage changes is crucial for beneficiaries seeking affordable and necessary prescription drugs. Recent enhancements, including improved coverage in the donut hole, biosimilar discounts, expanded catastrophic coverage threshold, expanded MTM services, and enhanced information tools, contribute to greater affordability and accessibility. Beneficiaries are encouraged to remain informed, review their Part D plan regularly, and utilize available resources to make informed decisions about prescription drug coverage.

Disclaimer: The information provided is for educational purposes only and not legal or financial advice. Consult a qualified professional for personalized guidance regarding your specific situation.

Staying informed about changes to Medicare Part D medication coverage is essential for understanding how these updates may impact healthcare expenses and treatment options. This blog post will explore the recent Medicare Part D medication coverage improvements that the Infl initiated by the Inflation Reduction Act.

1. The law requires the federal government to negotiate prices for some high-cost drugs covered under Medicare. Medicare Part D and Part B drug spending are highly concentrated among a relatively small share of covered drugs, mainly those without generic or biosimilar competitors. Under the Inflation Reduction Act, brand-name and biologic drugs without generic or biosimilar equivalents covered under Medicare Part D that are among the highest-spending Medicare-covered drugs are eligible for negotiation. The number of negotiated drugs is limited to 10 Part D drugs in 2026, another 15 Part D drugs in 2027, another 15 Part B and Part D drugs in 2028, and another 20 Part B and Part D drugs in 2029 and later years.

2. The law requires drug manufacturers to pay Medicare rebates if they increase prices faster than inflation for drugs used by Medicare beneficiaries. The inflation rebate provision will be implemented in 2023, using 2021 as the base year for determining price changes relative to inflation.

3. The law Caps Medicare beneficiaries' out-of-pocket spending under the Medicare Part D benefit, first eliminating coinsurance above the catastrophic threshold in 2024 and then adding a $2,000 cap on spending in 2025. It also limits annual increases in Part D premiums from 2024 to 2030 and makes other changes to the Part D benefit design.

4. Beginning in 2023, the bill limits cost-sharing for insulin to $35 per month for people with Medicare, including covered insulin products in Medicare Part D plans, beginning January 1, 2023, and for insulin furnished through durable medical equipment under Medicare Part B, starting July 1, 2023.

5. Eliminates cost-sharing for adult vaccines covered under Medicare Part D, as of 2023, and improves access to adult vaccines under Medicaid and CHIP.

6. It expands eligibility for full Part D Low-Income Subsidies (LIS) in 2024 to low-income beneficiaries with incomes up to 150% of poverty and modest assets and repeals the partial LIS benefit currently in place for individuals with incomes between 135% and 150% of poverty.

7. Expanded Medication Therapy Management (MTM) Services: MTM services have been expanded to provide enhanced support and guidance. This helps ensure effective medication use, improves health outcomes, and minimizes drug-related issues.

8. Enhanced Information and Decision-Making Tools: Beneficiaries now have improved resources for informed decision-making. The updated Plan Finder tool offers accurate cost estimates and helps select the most suitable Part D plan based on individual medication needs.

Conclusion: Staying updated on Medicare Part D medication coverage changes is crucial for beneficiaries seeking affordable and necessary prescription drugs. Recent enhancements, including improved coverage in the donut hole, biosimilar discounts, expanded catastrophic coverage threshold, expanded MTM services, and enhanced information tools, contribute to greater affordability and accessibility. Beneficiaries are encouraged to remain informed, review their Part D plan regularly, and utilize available resources to make informed decisions about prescription drug coverage.

Disclaimer: The information provided is for educational purposes only and not legal or financial advice. Consult a qualified professional for personalized guidance regarding your specific situation.

Staying informed about changes to Medicare Part D medication coverage is essential for understanding how these updates may impact healthcare expenses and treatment options. This blog post will explore the recent Medicare Part D medication coverage improvements that the Infl initiated by the Inflation Reduction Act.

1. The law requires the federal government to negotiate prices for some high-cost drugs covered under Medicare. Medicare Part D and Part B drug spending are highly concentrated among a relatively small share of covered drugs, mainly those without generic or biosimilar competitors. Under the Inflation Reduction Act, brand-name and biologic drugs without generic or biosimilar equivalents covered under Medicare Part D that are among the highest-spending Medicare-covered drugs are eligible for negotiation. The number of negotiated drugs is limited to 10 Part D drugs in 2026, another 15 Part D drugs in 2027, another 15 Part B and Part D drugs in 2028, and another 20 Part B and Part D drugs in 2029 and later years.

2. The law requires drug manufacturers to pay Medicare rebates if they increase prices faster than inflation for drugs used by Medicare beneficiaries. The inflation rebate provision will be implemented in 2023, using 2021 as the base year for determining price changes relative to inflation.

3. The law Caps Medicare beneficiaries' out-of-pocket spending under the Medicare Part D benefit, first eliminating coinsurance above the catastrophic threshold in 2024 and then adding a $2,000 cap on spending in 2025. It also limits annual increases in Part D premiums from 2024 to 2030 and makes other changes to the Part D benefit design.

4. Beginning in 2023, the bill limits cost-sharing for insulin to $35 per month for people with Medicare, including covered insulin products in Medicare Part D plans, beginning January 1, 2023, and for insulin furnished through durable medical equipment under Medicare Part B, starting July 1, 2023.

5. Eliminates cost-sharing for adult vaccines covered under Medicare Part D, as of 2023, and improves access to adult vaccines under Medicaid and CHIP.

6. It expands eligibility for full Part D Low-Income Subsidies (LIS) in 2024 to low-income beneficiaries with incomes up to 150% of poverty and modest assets and repeals the partial LIS benefit currently in place for individuals with incomes between 135% and 150% of poverty.

7. Expanded Medication Therapy Management (MTM) Services: MTM services have been expanded to provide enhanced support and guidance. This helps ensure effective medication use, improves health outcomes, and minimizes drug-related issues.

8. Enhanced Information and Decision-Making Tools: Beneficiaries now have improved resources for informed decision-making. The updated Plan Finder tool offers accurate cost estimates and helps select the most suitable Part D plan based on individual medication needs.

Conclusion: Staying updated on Medicare Part D medication coverage changes is crucial for beneficiaries seeking affordable and necessary prescription drugs. Recent enhancements, including improved coverage in the donut hole, biosimilar discounts, expanded catastrophic coverage threshold, expanded MTM services, and enhanced information tools, contribute to greater affordability and accessibility. Beneficiaries are encouraged to remain informed, review their Part D plan regularly, and utilize available resources to make informed decisions about prescription drug coverage.

Disclaimer: The information provided is for educational purposes only and not legal or financial advice. Consult a qualified professional for personalized guidance regarding your specific situation.

NJ is making a mistake by robbing the group health market to pay for the NJHPTC.

Thursday, March 24, 2023 Craig E Chapin, Pesident

Using NJ state and federal subsidies, the Affordable Care Act (ACA) helps eligible individuals and families afford health insurance. The American Rescue Plan Act has increased the amount of financial help available, with no one paying more than 8.5% of their income for health insurance when not offered affordable group health insurance through work. New Jersey has its own subsidy program, the New Jersey Health Insurance Premium Tax Credit (NJHPTC), funded by state taxes, fees, and assessments on health insurance companies and hospitals, as well as the state's general fund. However, NJ added subsidy may cause small employers to stop offering group health plans.

To be eligible for NJHPTC, individuals, and families must meet certain income requirements, and the amount of subsidy varies based on the number of insured individuals. For example, an individual making 150% of the Federal Poverty Level will receive combined subsidies, making many health plans have zero premiums. Adults making less than 401% of the FPL get an extra $100 a month, and incomes between 401% to 600% of the FPL will get $50 a month.

Children dependents under age 19 default to the Children's Health Insurance Program at zero cost if the household earns less than 355% of the FPL. The adults receive the NJHPTC as indicated above. If the child is over 18, they are treated as an adult, getting up to an additional $100 credit per child under 400% of the FPL and $50 from 401% up to 600% of the FPL.

The CHIP insures over one million children in NJ, and growing the pool is a priority to move to a one-payer system. To avoid a child's eligibility for CHIP, the family must report an income over 355% of the FPL, or they can refuse the free coverage and enroll their children in a non-subsidized plan through the same insurance companies offered to adults. The Child Health Insurance Program offers comprehensive coverage, including dental and vision.

When a state takes funds from the health industry and hospitals to fund the subsidy, insurance companies and hospitals will pass the cost on to all users, increasing the overall cost. Eventually, as small group premiums increase, many employers will stop offering group coverage and direct employees to purchase subsidized individual plans. The Family Glitch Fix will further enlighten employers about how little individuals pay for health insurance. The fix allows dependents of employees covered by group health plans to enroll in subsidized individual health plans if the household cost is determined unaffordable. Groups under 50 employees do not have a penalty for not offering health insurance, so when the cost can be sliced in half, an employer's premium contributions may be better allocated to other benefits or an increase in pay.

The subsidy programs aim to balance the cost burden across different groups, with the hope that increased access to healthcare will ultimately lead to better health outcomes and lower overall healthcare costs in the long run. With over forty years of experience, I feel usage will increase, moral hazard will not lead to better healthcare outcomes, and participants will demand the entitlement to be maintained while others pay the cost.

Using NJ state and federal subsidies, the Affordable Care Act (ACA) helps eligible individuals and families afford health insurance. The American Rescue Plan Act has increased the amount of financial help available, with no one paying more than 8.5% of their income for health insurance when not offered affordable group health insurance through work. New Jersey has its own subsidy program, the New Jersey Health Insurance Premium Tax Credit (NJHPTC), funded by state taxes, fees, and assessments on health insurance companies and hospitals, as well as the state's general fund. However, NJ added subsidy may cause small employers to stop offering group health plans.

To be eligible for NJHPTC, individuals, and families must meet certain income requirements, and the amount of subsidy varies based on the number of insured individuals. For example, an individual making 150% of the Federal Poverty Level will receive combined subsidies, making many health plans have zero premiums. Adults making less than 401% of the FPL get an extra $100 a month, and incomes between 401% to 600% of the FPL will get $50 a month.

Children dependents under age 19 default to the Children's Health Insurance Program at zero cost if the household earns less than 355% of the FPL. The adults receive the NJHPTC as indicated above. If the child is over 18, they are treated as an adult, getting up to an additional $100 credit per child under 400% of the FPL and $50 from 401% up to 600% of the FPL.

The CHIP insures over one million children in NJ, and growing the pool is a priority to move to a one-payer system. To avoid a child's eligibility for CHIP, the family must report an income over 355% of the FPL, or they can refuse the free coverage and enroll their children in a non-subsidized plan through the same insurance companies offered to adults. The Child Health Insurance Program offers comprehensive coverage, including dental and vision.

When a state takes funds from the health industry and hospitals to fund the subsidy, insurance companies and hospitals will pass the cost on to all users, increasing the overall cost. Eventually, as small group premiums increase, many employers will stop offering group coverage and direct employees to purchase subsidized individual plans. The Family Glitch Fix will further enlighten employers about how little individuals pay for health insurance. The fix allows dependents of employees covered by group health plans to enroll in subsidized individual health plans if the household cost is determined unaffordable. Groups under 50 employees do not have a penalty for not offering health insurance, so when the cost can be sliced in half, an employer's premium contributions may be better allocated to other benefits or an increase in pay.

The subsidy programs aim to balance the cost burden across different groups, with the hope that increased access to healthcare will ultimately lead to better health outcomes and lower overall healthcare costs in the long run. With over forty years of experience, I feel usage will increase, moral hazard will not lead to better healthcare outcomes, and participants will demand the entitlement to be maintained while others pay the cost.

Using NJ state and federal subsidies, the Affordable Care Act (ACA) helps eligible individuals and families afford health insurance. The American Rescue Plan Act has increased the amount of financial help available, with no one paying more than 8.5% of their income for health insurance when not offered affordable group health insurance through work. New Jersey has its own subsidy program, the New Jersey Health Insurance Premium Tax Credit (NJHPTC), funded by state taxes, fees, and assessments on health insurance companies and hospitals, as well as the state's general fund. However, NJ added subsidy may cause small employers to stop offering group health plans.

To be eligible for NJHPTC, individuals, and families must meet certain income requirements, and the amount of subsidy varies based on the number of insured individuals. For example, an individual making 150% of the Federal Poverty Level will receive combined subsidies, making many health plans have zero premiums. Adults making less than 401% of the FPL get an extra $100 a month, and incomes between 401% to 600% of the FPL will get $50 a month.

Children dependents under age 19 default to the Children's Health Insurance Program at zero cost if the household earns less than 355% of the FPL. The adults receive the NJHPTC as indicated above. If the child is over 18, they are treated as an adult, getting up to an additional $100 credit per child under 400% of the FPL and $50 from 401% up to 600% of the FPL.

The CHIP insures over one million children in NJ, and growing the pool is a priority to move to a one-payer system. To avoid a child's eligibility for CHIP, the family must report an income over 355% of the FPL, or they can refuse the free coverage and enroll their children in a non-subsidized plan through the same insurance companies offered to adults. The Child Health Insurance Program offers comprehensive coverage, including dental and vision.

When a state takes funds from the health industry and hospitals to fund the subsidy, insurance companies and hospitals will pass the cost on to all users, increasing the overall cost. Eventually, as small group premiums increase, many employers will stop offering group coverage and direct employees to purchase subsidized individual plans. The Family Glitch Fix will further enlighten employers about how little individuals pay for health insurance. The fix allows dependents of employees covered by group health plans to enroll in subsidized individual health plans if the household cost is determined unaffordable. Groups under 50 employees do not have a penalty for not offering health insurance, so when the cost can be sliced in half, an employer's premium contributions may be better allocated to other benefits or an increase in pay.

The subsidy programs aim to balance the cost burden across different groups, with the hope that increased access to healthcare will ultimately lead to better health outcomes and lower overall healthcare costs in the long run. With over forty years of experience, I feel usage will increase, moral hazard will not lead to better healthcare outcomes, and participants will demand the entitlement to be maintained while others pay the cost.

Using NJ state and federal subsidies, the Affordable Care Act (ACA) helps eligible individuals and families afford health insurance. The American Rescue Plan Act has increased the amount of financial help available, with no one paying more than 8.5% of their income for health insurance when not offered affordable group health insurance through work. New Jersey has its own subsidy program, the New Jersey Health Insurance Premium Tax Credit (NJHPTC), funded by state taxes, fees, and assessments on health insurance companies and hospitals, as well as the state's general fund. However, NJ added subsidy may cause small employers to stop offering group health plans.

To be eligible for NJHPTC, individuals, and families must meet certain income requirements, and the amount of subsidy varies based on the number of insured individuals. For example, an individual making 150% of the Federal Poverty Level will receive combined subsidies, making many health plans have zero premiums. Adults making less than 401% of the FPL get an extra $100 a month, and incomes between 401% to 600% of the FPL will get $50 a month.

Children dependents under age 19 default to the Children's Health Insurance Program at zero cost if the household earns less than 355% of the FPL. The adults receive the NJHPTC as indicated above. If the child is over 18, they are treated as an adult, getting up to an additional $100 credit per child under 400% of the FPL and $50 from 401% up to 600% of the FPL.

The CHIP insures over one million children in NJ, and growing the pool is a priority to move to a one-payer system. To avoid a child's eligibility for CHIP, the family must report an income over 355% of the FPL, or they can refuse the free coverage and enroll their children in a non-subsidized plan through the same insurance companies offered to adults. The Child Health Insurance Program offers comprehensive coverage, including dental and vision.

When a state takes funds from the health industry and hospitals to fund the subsidy, insurance companies and hospitals will pass the cost on to all users, increasing the overall cost. Eventually, as small group premiums increase, many employers will stop offering group coverage and direct employees to purchase subsidized individual plans. The Family Glitch Fix will further enlighten employers about how little individuals pay for health insurance. The fix allows dependents of employees covered by group health plans to enroll in subsidized individual health plans if the household cost is determined unaffordable. Groups under 50 employees do not have a penalty for not offering health insurance, so when the cost can be sliced in half, an employer's premium contributions may be better allocated to other benefits or an increase in pay.

The subsidy programs aim to balance the cost burden across different groups, with the hope that increased access to healthcare will ultimately lead to better health outcomes and lower overall healthcare costs in the long run. With over forty years of experience, I feel usage will increase, moral hazard will not lead to better healthcare outcomes, and participants will demand the entitlement to be maintained while others pay the cost.

All employees with dependents need to see if the "Family Glitch Fix" applies to them.

Thursday, March 16, 2023

The "Family Glitch Fix" allows employees with dependent group health coverage to save thousands. Once notified, the fix allows employee dependents denied access to subsidized individual health plans to enroll immediately.

Call us, and we can check affordability in seconds, then calculate your monthly savings in any health plan offered in your area. If your employer offers group health insurance and you have dependents, you may be able to lower your premium costs and their out-of-pocket costs for medical care.

The so-called "family glitch" stems from a 2013 IRS interpretation. Under Section 36B of the Internal Revenue Code, individuals generally do not qualify for premium tax credits if they are eligible for another source of minimum essential coverage, including employer-sponsored plans. There are two exceptions to this rule under the ACA-when the offer of job-based coverage is not "affordable" or not of "minimum value." If either exception is met, an individual is ineligible for minimum essential coverage, making them eligible for premium tax credits.

An employee needs to do this simple test with individual plans less expensive than most group health plans, even without subsidies. With federal and NJ subsidies, the monthly savings are larger than the average car payment.

The "Family Glitch Fix" allows employees with dependent group health coverage to save thousands. Once notified, the fix allows employee dependents denied access to subsidized individual health plans to enroll immediately.

Call us, and we can check affordability in seconds, then calculate your monthly savings in any health plan offered in your area. If your employer offers group health insurance and you have dependents, you may be able to lower your premium costs and their out-of-pocket costs for medical care.

The so-called "family glitch" stems from a 2013 IRS interpretation. Under Section 36B of the Internal Revenue Code, individuals generally do not qualify for premium tax credits if they are eligible for another source of minimum essential coverage, including employer-sponsored plans. There are two exceptions to this rule under the ACA-when the offer of job-based coverage is not "affordable" or not of "minimum value." If either exception is met, an individual is ineligible for minimum essential coverage, making them eligible for premium tax credits.

An employee needs to do this simple test with individual plans less expensive than most group health plans, even without subsidies. With federal and NJ subsidies, the monthly savings are larger than the average car payment.

The "Family Glitch Fix" allows employees with dependent group health coverage to save thousands. Once notified, the fix allows employee dependents denied access to subsidized individual health plans to enroll immediately.

Call us, and we can check affordability in seconds, then calculate your monthly savings in any health plan offered in your area. If your employer offers group health insurance and you have dependents, you may be able to lower your premium costs and their out-of-pocket costs for medical care.

The so-called "family glitch" stems from a 2013 IRS interpretation. Under Section 36B of the Internal Revenue Code, individuals generally do not qualify for premium tax credits if they are eligible for another source of minimum essential coverage, including employer-sponsored plans. There are two exceptions to this rule under the ACA-when the offer of job-based coverage is not "affordable" or not of "minimum value." If either exception is met, an individual is ineligible for minimum essential coverage, making them eligible for premium tax credits.

An employee needs to do this simple test with individual plans less expensive than most group health plans, even without subsidies. With federal and NJ subsidies, the monthly savings are larger than the average car payment.

The "Family Glitch Fix" allows employees with dependent group health coverage to save thousands. Once notified, the fix allows employee dependents denied access to subsidized individual health plans to enroll immediately.

Call us, and we can check affordability in seconds, then calculate your monthly savings in any health plan offered in your area. If your employer offers group health insurance and you have dependents, you may be able to lower your premium costs and their out-of-pocket costs for medical care.

The so-called "family glitch" stems from a 2013 IRS interpretation. Under Section 36B of the Internal Revenue Code, individuals generally do not qualify for premium tax credits if they are eligible for another source of minimum essential coverage, including employer-sponsored plans. There are two exceptions to this rule under the ACA-when the offer of job-based coverage is not "affordable" or not of "minimum value." If either exception is met, an individual is ineligible for minimum essential coverage, making them eligible for premium tax credits.

An employee needs to do this simple test with individual plans less expensive than most group health plans, even without subsidies. With federal and NJ subsidies, the monthly savings are larger than the average car payment.

What are the best health insurance options for small businesses in 2023

Thursday, February 23, 2023 Craig E Chapin, Pesident

In 2023, inflation is the central talking point, and health insurance premiums and medical costs are increasing. Small employers must look at benefit costs with salary, and supply costs increasing. If a business offers health insurance, there are three options; Level Funding, Fully Insured, and Individual Health Plans.

Level funding is the new option with reduced premiums and more comprehensive provider access for groups with good claims experience. Health questions are asked, and past medical usage is checked for insurance companies to select groups that are likely to have lower claims expenses than the premiums paid. Groups with as few as two employees can enroll, and the final premium rates remain level for the policy year. Level funding is a great place to start if you want to see if your groups can save while still having the option to fall back on guaranteed, fully insured health plans.

Fully insured plans are changing and offer savings by reducing provider access, especially to out-of-state providers. Many plan designs are moving away from copays on brand name prescriptions and shifting higher cost sharing to employees. The fully insured plans are favored by employers, paying the lion's share of premiums and wanting to offer benefits with little employee involvement.

The small group's health market is yielding to the individual health market that offers rich federal and (NJ State) premium subsidies to employees and cost-sharing reductions on out-of-pocket costs. The Family Glitch law allows dependents for employees covered by group insurance to take advantage of individual subsidies if the employee's cost to insure their dependents is unaffordable. In NJ, the state exploits the small group market by taking premiums and funding individuals not covered by group insurance.

The best program depends on the business's unique needs and its employees. All groups should offer health insurance as employees are also crushed by inflation. Employees need expert advice to take advantage of any offer and will be more productive, resulting in lower absenteeism from financial loss.

In 2023, inflation is the central talking point, and health insurance premiums and medical costs are increasing. Small employers must look at benefit costs with salary, and supply costs increasing. If a business offers health insurance, there are three options; Level Funding, Fully Insured, and Individual Health Plans.

Level funding is the new option with reduced premiums and more comprehensive provider access for groups with good claims experience. Health questions are asked, and past medical usage is checked for insurance companies to select groups that are likely to have lower claims expenses than the premiums paid. Groups with as few as two employees can enroll, and the final premium rates remain level for the policy year. Level funding is a great place to start if you want to see if your groups can save while still having the option to fall back on guaranteed, fully insured health plans.

Fully insured plans are changing and offer savings by reducing provider access, especially to out-of-state providers. Many plan designs are moving away from copays on brand name prescriptions and shifting higher cost sharing to employees. The fully insured plans are favored by employers, paying the lion's share of premiums and wanting to offer benefits with little employee involvement.

The small group's health market is yielding to the individual health market that offers rich federal and (NJ State) premium subsidies to employees and cost-sharing reductions on out-of-pocket costs. The Family Glitch law allows dependents for employees covered by group insurance to take advantage of individual subsidies if the employee's cost to insure their dependents is unaffordable. In NJ, the state exploits the small group market by taking premiums and funding individuals not covered by group insurance.

The best program depends on the business's unique needs and its employees. All groups should offer health insurance as employees are also crushed by inflation. Employees need expert advice to take advantage of any offer and will be more productive, resulting in lower absenteeism from financial loss.

In 2023, inflation is the central talking point, and health insurance premiums and medical costs are increasing. Small employers must look at benefit costs with salary, and supply costs increasing. If a business offers health insurance, there are three options; Level Funding, Fully Insured, and Individual Health Plans.

Level funding is the new option with reduced premiums and more comprehensive provider access for groups with good claims experience. Health questions are asked, and past medical usage is checked for insurance companies to select groups that are likely to have lower claims expenses than the premiums paid. Groups with as few as two employees can enroll, and the final premium rates remain level for the policy year. Level funding is a great place to start if you want to see if your groups can save while still having the option to fall back on guaranteed, fully insured health plans.

Fully insured plans are changing and offer savings by reducing provider access, especially to out-of-state providers. Many plan designs are moving away from copays on brand name prescriptions and shifting higher cost sharing to employees. The fully insured plans are favored by employers, paying the lion's share of premiums and wanting to offer benefits with little employee involvement.

The small group's health market is yielding to the individual health market that offers rich federal and (NJ State) premium subsidies to employees and cost-sharing reductions on out-of-pocket costs. The Family Glitch law allows dependents for employees covered by group insurance to take advantage of individual subsidies if the employee's cost to insure their dependents is unaffordable. In NJ, the state exploits the small group market by taking premiums and funding individuals not covered by group insurance.

The best program depends on the business's unique needs and its employees. All groups should offer health insurance as employees are also crushed by inflation. Employees need expert advice to take advantage of any offer and will be more productive, resulting in lower absenteeism from financial loss.

In 2023, inflation is the central talking point, and health insurance premiums and medical costs are increasing. Small employers must look at benefit costs with salary, and supply costs increasing. If a business offers health insurance, there are three options; Level Funding, Fully Insured, and Individual Health Plans.

Level funding is the new option with reduced premiums and more comprehensive provider access for groups with good claims experience. Health questions are asked, and past medical usage is checked for insurance companies to select groups that are likely to have lower claims expenses than the premiums paid. Groups with as few as two employees can enroll, and the final premium rates remain level for the policy year. Level funding is a great place to start if you want to see if your groups can save while still having the option to fall back on guaranteed, fully insured health plans.

Fully insured plans are changing and offer savings by reducing provider access, especially to out-of-state providers. Many plan designs are moving away from copays on brand name prescriptions and shifting higher cost sharing to employees. The fully insured plans are favored by employers, paying the lion's share of premiums and wanting to offer benefits with little employee involvement.

The small group's health market is yielding to the individual health market that offers rich federal and (NJ State) premium subsidies to employees and cost-sharing reductions on out-of-pocket costs. The Family Glitch law allows dependents for employees covered by group insurance to take advantage of individual subsidies if the employee's cost to insure their dependents is unaffordable. In NJ, the state exploits the small group market by taking premiums and funding individuals not covered by group insurance.

The best program depends on the business's unique needs and its employees. All groups should offer health insurance as employees are also crushed by inflation. Employees need expert advice to take advantage of any offer and will be more productive, resulting in lower absenteeism from financial loss.

The Inflation Reduction Act is welcome news for individual health participants.

Wednesday, August 24, 2022 Craig E. Chapin

The Inflation Reduction act guarantees funding to ACA individual insurance market for the next three years with the enhancements implemented by the American Rescue Law of 2021. Premium subsidies are increased for a household earning less than 400% of the Federal Poverty Level (FPL). The "Income Cliff" has been eliminated, limiting costs to homes at any income to 8.5% if not offered group insurance, based on the second lowest silver level plan in their zip code. The "Family Glitch" is removed, limiting a family's cost to 9.12% of household income even when offered group health insurance through work.

Many small employers will embrace the change allowing low-income employees to take advantage of subsidies while continuing to fund health premiums for higher-paid employees that do not qualify for subsidies. An ICHRA will enable employers to set up a special enrollment event to transition employees from group to individual plans.

A families premium cost as a percentage of the federal poverty level

The Inflation Reduction act guarantees funding to ACA individual insurance market for the next three years with the enhancements implemented by the American Rescue Law of 2021. Premium subsidies are increased for a household earning less than 400% of the Federal Poverty Level (FPL). The "Income Cliff" has been eliminated, limiting costs to homes at any income to 8.5% if not offered group insurance, based on the second lowest silver level plan in their zip code. The "Family Glitch" is removed, limiting a family's cost to 9.12% of household income even when offered group health insurance through work.

Many small employers will embrace the change allowing low-income employees to take advantage of subsidies while continuing to fund health premiums for higher-paid employees that do not qualify for subsidies. An ICHRA will enable employers to set up a special enrollment event to transition employees from group to individual plans.

A families premium cost as a percentage of the federal poverty level

The Inflation Reduction act guarantees funding to ACA individual insurance market for the next three years with the enhancements implemented by the American Rescue Law of 2021. Premium subsidies are increased for a household earning less than 400% of the Federal Poverty Level (FPL). The "Income Cliff" has been eliminated, limiting costs to homes at any income to 8.5% if not offered group insurance, based on the second lowest silver level plan in their zip code. The "Family Glitch" is removed, limiting a family's cost to 9.12% of household income even when offered group health insurance through work.

Many small employers will embrace the change allowing low-income employees to take advantage of subsidies while continuing to fund health premiums for higher-paid employees that do not qualify for subsidies. An ICHRA will enable employers to set up a special enrollment event to transition employees from group to individual plans.

A families premium cost as a percentage of the federal poverty level

The Inflation Reduction act guarantees funding to ACA individual insurance market for the next three years with the enhancements implemented by the American Rescue Law of 2021. Premium subsidies are increased for a household earning less than 400% of the Federal Poverty Level (FPL). The "Income Cliff" has been eliminated, limiting costs to homes at any income to 8.5% if not offered group insurance, based on the second lowest silver level plan in their zip code. The "Family Glitch" is removed, limiting a family's cost to 9.12% of household income even when offered group health insurance through work.

Many small employers will embrace the change allowing low-income employees to take advantage of subsidies while continuing to fund health premiums for higher-paid employees that do not qualify for subsidies. An ICHRA will enable employers to set up a special enrollment event to transition employees from group to individual plans.

A families premium cost as a percentage of the federal poverty level

- 100% to 133%: Zero Premium Plus Cost Sharing Reductions (CSR)

- 133% to 159%: Zero Premium Plus CSR

- 150% to 200%: Zero to 2% Plus CRS

- 200% to 250%: 2% to 4% Plus CRS

- 250% to 300%: 4% to 6%

- 300% to 300%: 6% to 8.5%

- Over 400%: 8.5%

Offering an ICHRA allows families to elect subsidized Health Plans

Tuesday, October 03, 2021

ICHRA is an employer-funded health benefit that is used to reimburse employees for individual health insurance premiums and healthcare expenses. This exciting benefit gives employers a practical option that creates flexibility and maintains employee satisfaction.

Why is ICHRA such a big deal?

Employers can reimburse employees that do not qualify for Federal subsidies given by the Affordable Care Act and enhanced by the American Rescue Law. With proper plan design, most employees will elect the subsidies for their entire family, so the employer contributes nothing. There are no participation requirements or minimum employer contributions that are part of any group plans. Lastly, the ICHRA allows for a special enrollment event so employers can start a plan any time of the year.

Employee Classes Defined

The ICHRA comes with 11 different employee classes businesses can leverage while structuring benefit eligibility and allowance amounts. The classes separate employees into groups by job-based criteria that include locations, tenure, hours worked, and more. The 11 classes are as follows:

ICHRA is an employer-funded health benefit that is used to reimburse employees for individual health insurance premiums and healthcare expenses. This exciting benefit gives employers a practical option that creates flexibility and maintains employee satisfaction.

Why is ICHRA such a big deal?

Employers can reimburse employees that do not qualify for Federal subsidies given by the Affordable Care Act and enhanced by the American Rescue Law. With proper plan design, most employees will elect the subsidies for their entire family, so the employer contributes nothing. There are no participation requirements or minimum employer contributions that are part of any group plans. Lastly, the ICHRA allows for a special enrollment event so employers can start a plan any time of the year.

Employee Classes Defined

The ICHRA comes with 11 different employee classes businesses can leverage while structuring benefit eligibility and allowance amounts. The classes separate employees into groups by job-based criteria that include locations, tenure, hours worked, and more. The 11 classes are as follows:

- Full-time employees

- Part-time employees

- Salaried employees

- Hourly employees

- Temporary employees of staffing firms

- Seasonal employees

- Employees covered under a collective bargaining agreement

- Employees in a waiting period

- Foreign employees who work abroad

- Employees in different locations, based on rating areas

- A combination of two or more of the above

- 10 employees for employers with fewer than 100 employees

- 10 percent of the total number of employees for employers with between 100 and 200 employees

- 20 employees for employers with more than 200 employees

The ICHRA law gives groups more flexibility.

Friday, October 1, 2021 Craig Chapin

The ICHRA law allows a large employer to meet ACA mandated premiums contributions while not excluding an employee's dependents from taking advantage of individual subsides. The law gives small groups a special enrollment event to offer more choice to employees and voluntary options for individual health subsidies.

In March 2021, The American Rescue law increased federal subsidies to lower the premiums for individuals not offered group health insurance at work. The law also eliminated the income cliff that restricted premium subsidies for anyone earning over 400% of the Federal Poverty Level. Now any qualified individual will not pay more than 8.5% of their household income for their entire family, and most will pay much less. Many groups want to offer employees savings but are not aware of the rules.

The ICHRA law starts a special enrollment event to enroll employees into individual plans at any time of the year. The law allows employers to contribute to their employee's costs and also contribute to their out-of-pocket costs. Employers can offer employees more choice of plans, better network access, and their dependents have full access to health plans with federal and state subsidies to lower their costs. Employers can use classes to segment their employees with different benefits to accommodate management, out-of-state employees, hourly, seasonal, etc., offering employees lower prices and better network access.

Every group needs to take the time to learn the benefits and rules, and individuals pay on average $10 a month using individual plans verse group premiums of $300 or more.

The ICHRA law allows a large employer to meet ACA mandated premiums contributions while not excluding an employee's dependents from taking advantage of individual subsides. The law gives small groups a special enrollment event to offer more choice to employees and voluntary options for individual health subsidies.

In March 2021, The American Rescue law increased federal subsidies to lower the premiums for individuals not offered group health insurance at work. The law also eliminated the income cliff that restricted premium subsidies for anyone earning over 400% of the Federal Poverty Level. Now any qualified individual will not pay more than 8.5% of their household income for their entire family, and most will pay much less. Many groups want to offer employees savings but are not aware of the rules.

The ICHRA law starts a special enrollment event to enroll employees into individual plans at any time of the year. The law allows employers to contribute to their employee's costs and also contribute to their out-of-pocket costs. Employers can offer employees more choice of plans, better network access, and their dependents have full access to health plans with federal and state subsidies to lower their costs. Employers can use classes to segment their employees with different benefits to accommodate management, out-of-state employees, hourly, seasonal, etc., offering employees lower prices and better network access.

Every group needs to take the time to learn the benefits and rules, and individuals pay on average $10 a month using individual plans verse group premiums of $300 or more.

The ICHRA law allows a large employer to meet ACA mandated premiums contributions while not excluding an employee's dependents from taking advantage of individual subsides. The law gives small groups a special enrollment event to offer more choice to employees and voluntary options for individual health subsidies.

In March 2021, The American Rescue law increased federal subsidies to lower the premiums for individuals not offered group health insurance at work. The law also eliminated the income cliff that restricted premium subsidies for anyone earning over 400% of the Federal Poverty Level. Now any qualified individual will not pay more than 8.5% of their household income for their entire family, and most will pay much less. Many groups want to offer employees savings but are not aware of the rules.

The ICHRA law starts a special enrollment event to enroll employees into individual plans at any time of the year. The law allows employers to contribute to their employee's costs and also contribute to their out-of-pocket costs. Employers can offer employees more choice of plans, better network access, and their dependents have full access to health plans with federal and state subsidies to lower their costs. Employers can use classes to segment their employees with different benefits to accommodate management, out-of-state employees, hourly, seasonal, etc., offering employees lower prices and better network access.

Every group needs to take the time to learn the benefits and rules, and individuals pay on average $10 a month using individual plans verse group premiums of $300 or more.

The ICHRA law allows a large employer to meet ACA mandated premiums contributions while not excluding an employee's dependents from taking advantage of individual subsides. The law gives small groups a special enrollment event to offer more choice to employees and voluntary options for individual health subsidies.

In March 2021, The American Rescue law increased federal subsidies to lower the premiums for individuals not offered group health insurance at work. The law also eliminated the income cliff that restricted premium subsidies for anyone earning over 400% of the Federal Poverty Level. Now any qualified individual will not pay more than 8.5% of their household income for their entire family, and most will pay much less. Many groups want to offer employees savings but are not aware of the rules.

The ICHRA law starts a special enrollment event to enroll employees into individual plans at any time of the year. The law allows employers to contribute to their employee's costs and also contribute to their out-of-pocket costs. Employers can offer employees more choice of plans, better network access, and their dependents have full access to health plans with federal and state subsidies to lower their costs. Employers can use classes to segment their employees with different benefits to accommodate management, out-of-state employees, hourly, seasonal, etc., offering employees lower prices and better network access.

Every group needs to take the time to learn the benefits and rules, and individuals pay on average $10 a month using individual plans verse group premiums of $300 or more.