In today's evolving healthcare environment, innovative programs are reshaping how individuals access meaningful, affordable coverage. LifeX and Population Science Management (PSM) are leading the charge by offering a unique model: contribute to public health research through short, part-time surveys-and in return, gain access to comprehensive group health insurance.

How It Works

Both companies hire individuals as part-time associates to complete occasional surveys- each typically taking just 5 to 10 minutes, with only a few hours required over the course of a year. Participants are paid for their time and, more importantly, gain access to high-quality, off-exchange health insurance plans.

At

1 Stop Benefits, Inc., we're proud to serve as a recruiting partner for these programs, connecting individuals with this smart, impactful opportunity. It's a win-win: contribute to better public health while securing valuable coverage for yourself and your family.

Highlights of Off-Exchange Group Health Plans

- Flexible Plan Options -- Choose from a range of deductibles and coverage levels

- Great for High Earners -- Ideal for those ineligible for ACA subsidies

- Eligibility -- Available to 1099 contractors, self-employed professionals, and non-working individuals under age 65

By classifying survey participants as part-time associates, LifeX and PSM can offer group health plans-making comprehensive insurance accessible to more people, especially those who fall through the cracks of traditional systems.

Why PPO Networks Make a Difference

Both programs offer P

PO health plans, with these key advantages:

- No Balance Billing -- Pre-negotiated rates help reduce unexpected costs

- Lower Shared Expenses -- In-network care keeps your out-of-pocket costs down

- Comprehensive Benefits -- Includes telehealth, pharmacy coverage, and chronic care support

- Freedom of Access -- Nationwide networks with no referrals required

Network Availability

- LifeX -- Tiered premiums with access to PHCS, Cigna, and Anthem

- PSM -- Nationwide access via Blue Cross Blue Shield and PHCS

A Smarter Approach to Health Data

Beyond providing benefits, these companies use the collected data to drive positive health change. Here's how:

- Health Surveys + EHRs -- Combine insights for a full picture of health trends

- Predictive Analytics -- Identify emerging risks and support early intervention

- Personalized Solutions -- Tailor strategies to improve community health outcomes

The Bottom Line: Healthier You, Healthier Communities

This partnership between LifeX, PSM, and 1 Stop Benefits creates something truly unique: a way for individuals to earn supplemental income, contribute to public health, and receive the kind of health coverage often reserved for full-time employees.

Ready to learn more or see if you qualify?

Reach out to

1 Stop Benefits today-we're happy to walk you through your options and answer any questions, with no pressure. Call us at 1-800-662-3982 or email: info@1StopBenefits.com to get started.

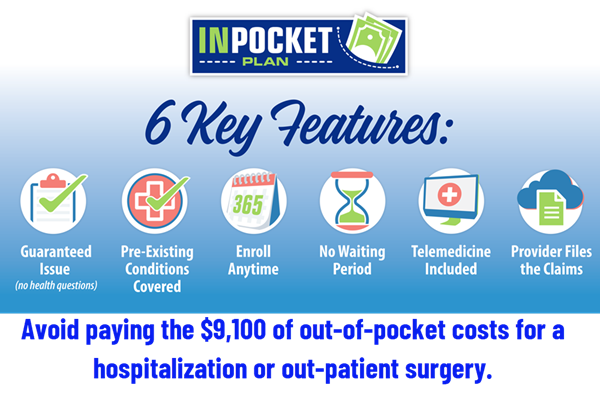

In an ever-changing healthcare landscape, arming yourself with knowledge about health insurance is vital not only for your physical health but also for your financial security. A new insurance plan offers relief to individuals covered by Affordable Care individual health plans regardless of medical conditions and without the standard exclusions. Now, having two insurance plans provides lower out-of-pocket costs than one. The MOOP (maximum out-of-pocket) expenses will be $9,200 per individual and $18,400 per family 2025. Tiered health plans can speed up your obligations. Start saving or read on.

In the insurance industry, one thing remains consistent. 20% of people use 80% of healthcare expenses. Since the Obama Care began, individuals have been insured regardless of their pre-existing conditions or medical expenses. Premium costs have been increasing every year since the law was passed. However, for many participants, the actual premium cost is not obvious as the subsidies granted by the Affordable Care Act offset the increases. What is apparent is that the out-of-pocket costs are increasing and are unaffordable for the average family.

For many, hospital indemnity insurance plans fill the gap for a fraction of the cost of buying up to gold health plans. However, not all states allow hospital indemnity plans to be offered to individuals. Most do not cover the significant upfront costs on the first day in the hospital, and few cover outpatient surgeries. Most are also unavailable to people with pre-existing conditions, and just about all do not cover maternity and mental health expenses.

Life happens, and everyone needs to set up an emergency fund or leverage their limited funds. Solutions now exist to cover your medical bills for accidents only or both sickness and accidents. Do the math to save money by comparing the MOOP and premiums on bronze, silver, and gold individual health plans. People covered by tiered networks (i.e., Proactive Plans) must understand that an ambulance takes you to the nearest hospital regardless of tier status or network. (St Mary's is Tier 3 with Keystone Proactive Plans). Consider lowering your out-of-pocket costs for families planning on more children or baby boomers with a higher risk of hospitalization. Sleep better knowing you can afford to be taken to the nearest hospital or get treated without the risk of medical bankruptcy.

In an ever-changing healthcare landscape, arming yourself with knowledge about health insurance is vital not only for your physical health but also for your financial security. A new insurance plan offers relief to individuals covered by Affordable Care individual health plans regardless of medical conditions and without the standard exclusions. Now, having two insurance plans provides lower out-of-pocket costs than one. The MOOP (maximum out-of-pocket) expenses will be $9,200 per individual and $18,400 per family 2025. Tiered health plans can speed up your obligations. Start saving or read on.

In the insurance industry, one thing remains consistent. 20% of people use 80% of healthcare expenses. Since the Obama Care began, individuals have been insured regardless of their pre-existing conditions or medical expenses. Premium costs have been increasing every year since the law was passed. However, for many participants, the actual premium cost is not obvious as the subsidies granted by the Affordable Care Act offset the increases. What is apparent is that the out-of-pocket costs are increasing and are unaffordable for the average family.

For many, hospital indemnity insurance plans fill the gap for a fraction of the cost of buying up to gold health plans. However, not all states allow hospital indemnity plans to be offered to individuals. Most do not cover the significant upfront costs on the first day in the hospital, and few cover outpatient surgeries. Most are also unavailable to people with pre-existing conditions, and just about all do not cover maternity and mental health expenses.

Life happens, and everyone needs to set up an emergency fund or leverage their limited funds. Solutions now exist to cover your medical bills for accidents only or both sickness and accidents. Do the math to save money by comparing the MOOP and premiums on bronze, silver, and gold individual health plans. People covered by tiered networks (i.e., Proactive Plans) must understand that an ambulance takes you to the nearest hospital regardless of tier status or network. (St Mary's is Tier 3 with Keystone Proactive Plans). Consider lowering your out-of-pocket costs for families planning on more children or baby boomers with a higher risk of hospitalization. Sleep better knowing you can afford to be taken to the nearest hospital or get treated without the risk of medical bankruptcy.